Hi all, welcome back to Twenty2Cents. This week I want to talk about the most important building block for your economic foundation: how to save money.

Most people I know have struggled with this at some point, myself included. Up until my mid 20’s, I lived paycheck to paycheck and spent nearly every dime I made. My expenses were low, my income was high (relatively) and I wasted most of money on things that weren’t meaningful. I’d start saving for a few months at a time but I would always inevitably fall off the rails. Looking back, I didn’t truly understand why I should be saving money, how to approach it, or the psychology behind it. This article for is anyone who wants to start saving money but doesn’t know where to start, or has tried saving in the past but can’t seem to stay on track. Regardless of where you are in life, the plan I’ll outline below will be useful for anyone who wants to get a better grip on their finances. The best day to start saving is yesterday, and the next best day to start is today.

If you’re new here and wondering what this website is about, you can check out last week’s introductory post here. Now let’s talk money.

Why Save Money?

Almost all of you will have been told by someone that it’s a good idea to save money. They were right. But they might not have fully articulated why you should save money. Let me explain. They way I see it, there are really three main reasons why you should be saving:

- Emergencies & Unexpected

- Big Ticket Items

- Financial Freedom

Let’s break these down one by one.

Emergencies & The Unexpected

Life’s crazy ya’ll. If there is one thing you can expect in life, it’s the unexpected. Medical bills, unexpected car repairs, losing your job, you name it and it can happen to you. Maybe not today, maybe not tomorrow, but eventually you are going to be spending more, or earning less, than you expected. Best to save some money for these scenarios to minimize stress and hardship.

Big Ticket Items

This is a catch all phrase that encompasses all the things that you want or need at some point, but can’t afford right now. I’m talking about houses, properties, vacations, a new computer, you get the gist. Anything that requires you to accumulate money for some period of time so you can afford it later falls into this bucket. Purchases like this require planning – you’ll probably never take that 2 month dream vacation to Japan if you don’t plan for it.

Financial Freedom

Arguably the most motivating reason of the three (to me), financial freedom means that you don’t have to work for money. You can if you want to, but you don’t have to. For a lot of people this is the goal of retirement. If you’re financially free you have more choice over how you spend your time; you can work on the things you love, spend all day gardening, weave baskets underwater, whatever! Freedom looks different to everyone but that’s the point; you are free and therefore it’s up to you how you spend your time. Unless you’re a high earner, this usually requires many years of spending less than you make (saving) and investing. However, it is achievable for everyone.

How to Save Money

Now that we’ve got the why in clear view, let’s talk about how to start saving. The concept of saving is simple; spend less than you earn. Do this over the long haul and you’ll be sitting on some phat bags in your golden years. Although it sounds simple enough, in practice many people struggle to save consistently. Let’s outline a step by step plan for saving that you can stick to.

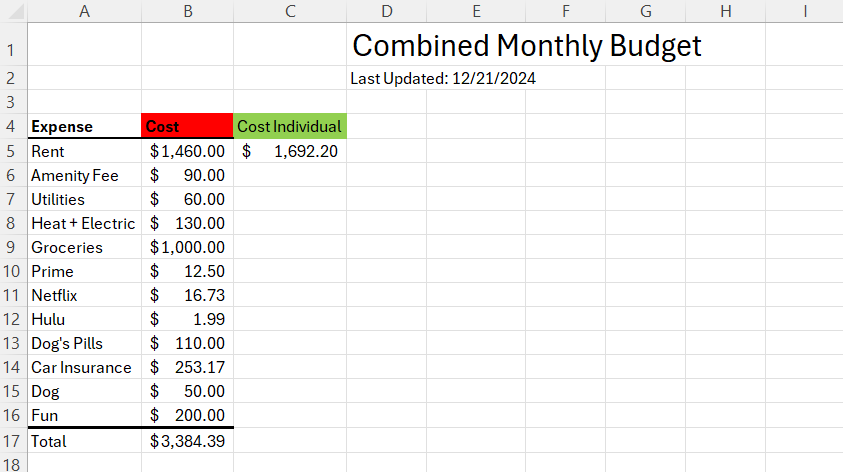

Example spreadsheet my girlfriend and I used to calculate our combined monthly expenses.

Step 1: Calculate Expenses

Before you can start saving money for later, you need to know how much money you need right now. Add up everything that costs you money each month and that’s your monthly expenses. While doing so, separate your expenses into two main categories: necessities and fun. Let’s define these real quick.

Necessities

Necessities include anything you need to survive or maintain your health. Rent and food are the most common examples of necessities, since you can’t live without food and you need some form of shelter. A car would be another example for people who commute to work and need a method of transportation. Since work=money and money=survival, the car is a necessity. Some of you might also have necessities that are unique to your situation. You might need medication for a medical condition, or maybe you see a therapist regularly and it keeps your mental health in check. Those are necessities as well. An example of one of my unique “necessities” is my gym membership. Although I wouldn’t actually die without it, I’d probably feel like dying if I couldn’t lift, and I am a firm believer that health is wealth. Besides, the economic benefit I get from being more productive due to being healthier probably outweighs the $35 I pay each month. In the necessity bucket it goes.

Fun

The fun category is just what it sounds like – anything you spend money on just for enjoyment. How often do you go out to eat? Do you go to the movies often? What about traveling? Do you grab a $6 Starbucks on the way to work everyday? (no, it’s not a necessity). You get the idea. Any and everything that isn’t necessary for your survival or health goes into this category.

Be Thorough

Once you’ve totaled all your expenses up for each category, add the totals together and you have your monthly expenses. If it seems high, don’t worry. We’ll talk about how to make changes in a bit. Although this is a simple calculation, really take some time to make sure you’re including everything you spend money on. If this first step isn’t thorough, you’ll end up overextending yourself by trying to save too much and not leaving yourself enough for your bills. This is why many people fail to stay consistent with their savings. Take your time.

Step 2: Calculate How Much You Can Save

Now that you know how much you’re currently spending, it’s time to figure out how much you can save while maintaining your lifestyle. Calculate how much you get paid in a month, subtract the total expenses from the last step, and voila! The difference is the amount of money you are receiving each month but don’t need. That is the amount of money that you are going to put into savings accounts.

But what if you don’t like that number? Maybe you want to save aggressively but the number you just came up with was small. Even worse that number could be negative, meaning that you are spending more than you are making each month. You have two options to bump up that savings number: make more or spend less. Both are plausible, but making more isn’t usually that easy and my guess is if you’re reading this you want to take action now. If that’s the case, the most immediate action you can take to increase your savings is to cut down on expenses.

Lowering Expenses

We put expenses into two categories in the last step so that if you need to make changes, you will have a better idea of where to start. Although expenses can be reduced in either category, it is typically easier to cut down on expenses in the fun category. A lot of necessities are long term commitments that are difficult to change or adjust (mortgages, apartment lease agreements, car loans, etc.). In the long term you can change these, but it takes time and often isn’t easy. Unless you are overpaying for one of your necessities, leave them alone for now. If you think you are overpaying… you probably are.

For more immediate changes, start by looking at the largest contributors to fun expenses and thinking about how you can get the same level of enjoyment for less money. A classic examples of a large fun expense is eating out frequently. Eating at restaurants, even at fast food places, is incredibly expensive compared to eating the same meal prepared at home. What is it about eating out that is enjoyable for you? If it’s the social aspect, replace it with another social activity like hiking or a game night at a friends house. If it’s the food, maybe you can try new recipes at home with or without friends. Figure out the source of joy in you fun activities, and think about how to get a similar experience for less.

Slow and Steady

Lowering your expenses while preserving your enjoyment requires some self-awareness and creativity. People value and enjoy activities to varying degrees, and it is up to you to decide what activities are the most important to you and which aren’t. When making lifestyle changes like this, start with small changes that are easy to stick to in order to build momentum. Small changes over long periods of time compound into big changes.

Step 3: Save Money Automatically

If you’ve followed step 1 and step 2, this is the easy part. Take the savings number you decided on in step 2, and set up an automatic deposit for that amount into a savings account every month. There are a number of ways to set this up. The best way is to set up a direct deposit with your employer for a fixed amount of your paycheck to to be deposited into a separate bank account every month. This way, the deposit happens automatically without you even having to think about it. Keep that other account for savings only, as it will serve as a strong psychological deterrent to you withdrawing it. You can also set up a reoccurring deposit from one of your bank accounts into a different bank account yourself if you’d rather not have your employer do it. Most online banking institutions allow you to do this and it is fairly straightforward to set up.

Wherever possible, I strongly advise anyone to automate the act of saving money and to keep money for savings separate from your typical checking account. There’s a lot to write about on this topic and I will certainly make a post going into more detail in the future. For now, know that managing money requires managing your own psychology and emotions, and the more you can automate the process of saving the more likely you are to stick to it.

Final Thoughts

I hope this post was helpful and provided some actionable takeaways for those of you trying to save your money. If you followed the above steps, and have come to the realization that you can’t save that much, that is ok. Don’t get discouraged. As time goes on you will acquire more skills and experience, increase your earnings, and have more to save. For now, saving anything at all is great. Figure out an amount that you save consistently and stick to it. By starting now you are building your mental muscle for saving and you will be better prepared to manage larger incomes later in life. This a marathon, not a race.

There’s plenty more to write about on this topic, but it’ll have to wait for another post. That’s my Twenty2Cents for the week. Catch ya next time.

If you absolutely can’t wait to read more, or this topic tickled your brain in just the right way, check out The Psychology of Money by Morgan Housel or The Algebra of Wealth by Scott Galloway. Both are great books with a lot of insights on personal finance, building a career, and the mechanics of money.

Questions? Suggestions? You can reach me on twitter or at chris@twenty2cents.com

-Chris